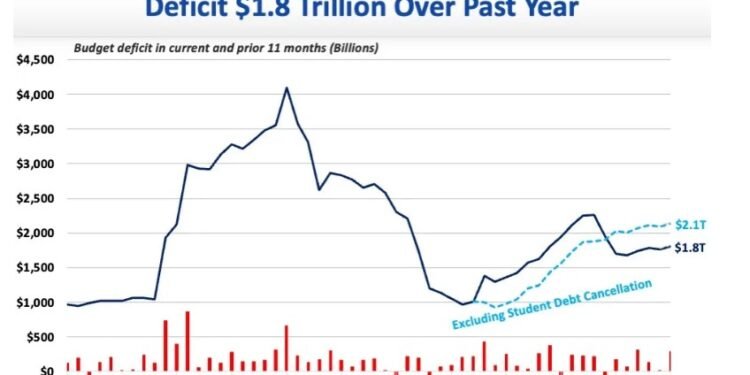

The U.S. Congressional Budget Office (CBO) has projected a staggering $1.8 trillion deficit for the fiscal year 2024, marking the highest level of federal debt since the COVID-19 pandemic. This massive shortfall highlights the continued fiscal challenges facing the U.S. government as it grapples with rising expenditures and slower-than-expected revenue growth.

Contents

- 1 Key Drivers of the Deficit

- 1.1 Related posts

- 1.2 Bail Bonds 101: A Step-by-Step Guide for Families and Defendants

- 1.3 New Polls Show Ghana’s Opposition Leader Poised for Victory in Upcoming Presidential Election

- 1.4 England’s Earps Breaks New Ground as the First Female Footballer Honored at Madame Tussauds

- 1.5 Referee David Coote Suspended by PGMOL Following Alleged Verbal Abuse of Liverpool and Klopp in Video

- 1.6 UK’s Starmer Set to Meet Macron in France to Strengthen Ukraine Support Following Trump Victory

- 1.7 Biden Extends Congratulations to Trump, Extends White House Invitation

- 1.8 Trump’s return to power fueled by Hispanic, working-class voter support

- 2 Comparison to COVID-Era Deficits

- 3 Broader Economic Implications

Key Drivers of the Deficit

The projected $1.8 trillion deficit can be attributed to several key factors, including increased government spending on entitlement programs, higher interest payments on national debt, and slower economic growth than initially forecasted. Social Security, Medicare, and Medicaid are among the major programs contributing to the increase in government spending as the aging population puts more pressure on the system.

Comparison to COVID-Era Deficits

While this projected deficit is the largest since the COVID-19 pandemic, it remains below the record-setting shortfalls seen during that time. In 2020, the U.S. federal deficit ballooned to $3.1 trillion, fueled by emergency spending on stimulus programs, unemployment benefits, and healthcare costs in response to the global health crisis. However, the current deficit projection signals that the U.S. government’s financial position has not yet fully recovered from the extraordinary fiscal measures taken during the pandemic.

Broader Economic Implications

The CBO projections have raised concerns among financial markets and international stakeholders, with the national debt currently standing at over $33 trillion. The increasing deficit heightens the risk of long-term financial instability, with potential consequences for inflation, interest rates, and the strength of the U.S. dollar on the global stage.`

Read more also:- Australia and New Zealand Prepare for Potential Bird Flu Outbreak