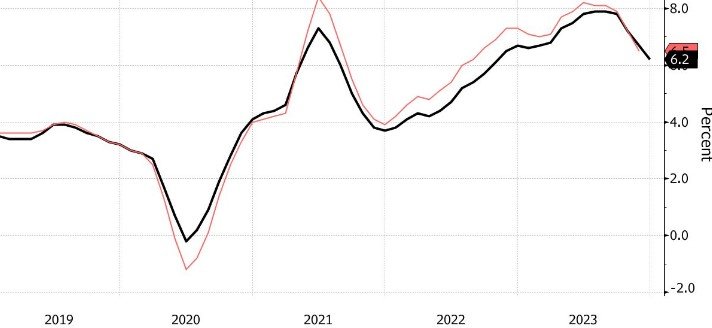

In a concerning development for the UK labor market, pay growth has slowed to its lowest rate since February 2021, according to the latest data from the Recruitment and Employment Confederation (REC). This downturn signals mounting economic challenges for both businesses and workers as inflation and rising costs continue to weigh on wage increases.

Contents

- 1 Sluggish Pay Growth Amid Economic Strain

- 1.1 Related posts

- 1.2 Bail Bonds 101: A Step-by-Step Guide for Families and Defendants

- 1.3 New Polls Show Ghana’s Opposition Leader Poised for Victory in Upcoming Presidential Election

- 1.4 England’s Earps Breaks New Ground as the First Female Footballer Honored at Madame Tussauds

- 1.5 Referee David Coote Suspended by PGMOL Following Alleged Verbal Abuse of Liverpool and Klopp in Video

- 1.6 UK’s Starmer Set to Meet Macron in France to Strengthen Ukraine Support Following Trump Victory

- 1.7 Biden Extends Congratulations to Trump, Extends White House Invitation

- 1.8 Trump’s return to power fueled by Hispanic, working-class voter support

- 2 Sectors Feeling the Pinch

- 3 Outlook for the Coming Months

Sluggish Pay Growth Amid Economic Strain

The REC report shows that UK employers are struggling to offer significant wage hikes, despite the persistent inflation and rising living costs. The data highlights that, while job openings remain strong in some sectors, wage growth is not keeping pace with economic pressures. This stagnation in pay has become a key issue for workers who are facing increasing expenses, particularly for essentials like food, energy, and housing.

Sectors Feeling the Pinch

The report highlights that wage growth has been especially slow in industries such as retail, hospitality, and construction, where cost inflation has hit hardest. Many businesses in these sectors are facing reduced consumer demand, making it difficult to offer higher wages without raising prices, which could further dampen demand.

Outlook for the Coming Months

Economists warn that unless inflation eases and the economic outlook improves, pay growth could continue to lag behind. This would leave households grappling with rising living costs without the cushion of higher wages, further eroding purchasing power. The Bank of England’s efforts to curb inflation through interest rate hikes may provide some relief, but these measures will take time to impact the labor market.

Read more also:- Zimbabwe Begins Compensation to Farmers Affected by Land Invasions